Björn Ulvaeus at the heart of the cashless society debate in Sweden (Updated)

As visitors to ABBA The Museum know, Björn Ulvaeus would like your money but not your cash. He insists that you pay for everything from your entrance fee to souvenirs from the museum shop by credit or debit card. This move has put Björn at the heart of the debate for a cashless Sweden.

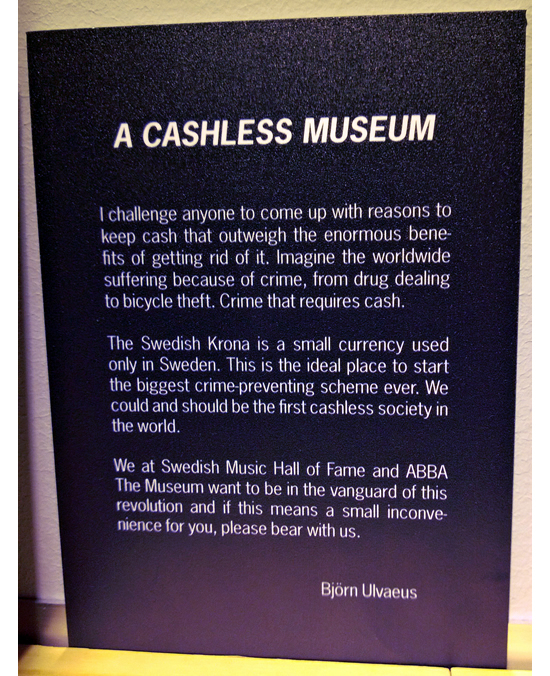

Now that the museum is roughly six months old, Björn has spoken to the Swedish financial media outlet ‘Dagens industri’ about the story so far and renews his plea for a cashless Sweden. The publication features arguments from both sides. This is Bjorn’s in his own words:

“Banknotes and coins are expensive to manage, contribute to crime and are unhygienic. At ABBA The Museum we decided from the beginning not to accept cash as payment. It has been shown to work very well,” says Björn Ulvaeus.

“In today’s news, I read the headline ‘one in every eight homes affected by break-ins every year’. The article talks about all possible prevention measures except one. It is the easiest to implement and absolutely the most efficient – remove the cash in society. At the moment, nobody has been able to explain to me what the thief is going to do with what he or she stole in the villa or apartment unless it can be turned into cash.

“Early on we decided that ABBA The Museum would take the lead in the move towards a cashless society. There were many ‘Cassandras’ who croaked that it was crazy if we took such a risk. But that risk, if it existed, we were prepared to take. We have now been open for almost half a year and it’s the accumulated experience, that I would like to present here.

“Not even 1% of our visitors do not have a debit or credit card. They can buy prepaid cards around the corner, from our friends at the Melody restaurant, so they come in anyway.

“Those who whine most loudly will usually be from Germany or Russia. In those countries, you apparently pay a percentage of the sum to buy something in the form of a fee to the card company, so it is understandable. Such aberrations are fortunately, as far as I know, not in our country.

“Many, especially the elderly, are uncertain and unaccustomed to paying by credit card, but it turns out that they almost always have one with them, whether they can remember the PIN code at first or not, so that even they manage to pay by card in the end, even if it is manually.

“Many of our visitors, especially the Swedes actually, commend us on having taken this step, they tell the staff so. They see the benefits of increased personal safety, efficiency, hygiene and the environment. We are just one of many cashless businesses in our country and all the time there are more coming onboard. Why can we not take the plunge and make Sweden the first cashless country on Earth?

“There are those who say that the black economy is the oil in the white government machinery, but I do not think that applies here. We Swedes are quite unique in that we have confidence in our institutions, we have an impartial public service that does not have that type of oil. The corruption in the local government sector, which we occasionally read about, must be hunted down with a blowtorch. The hunt will be more effective if bribes can never consist of cash.

“A widespread misconception is that it costs more to use cards than cash. In fact, it’s the other way around. Those who persist in using coins and banknotes and can be said to be anti-social, for the banks are passing on these costs, which are gigantic, to us in the form of lower deposit rates and higher lending etc. Someone is paying for the management of all this cash production, from chopping down trees and mining ore to distributing the money via armed transportation.

“Money is literally dirty, it teems with bacteria, and Swedish cash is among the worst in Europe. I saw the other day a man who obviously had a bad cold. He sneezed into his hand and then with the same hand picked up a hundred and handed it to the clerk, who had to take the corner of the note, pinching it between her thumb and forefinger.

“A majority of Swedes think that Euro banknotes and coins are the most unhygienic everyday objects. It is time that we get rid of them.”

UPDATE: 30 October 2013

Björn’s article in ‘Dagens industri’ provoked a lot of reaction, much of it negative. Björn answer some of the critics in a follow up piece:

Wow, what strong feelings my article on the removal of cash from society stirred up. Apparently, those paper notes have for many a symbolic value, which is much larger than the denomination written on the banknote itself.

After long and accurately reflecting, I myself have come to the conclusion that cash is probably not something that I personally need to carry and that by not using it, I am not concerned by any implications regarding my privacy and personal freedoms. But this my just my opinion, there are apparently many who do not share it.

“I really don’t know what electronic device may have effects in this area, but it is certainly worth a proper investigation.”

Agnes Wold, professor of Clinical Microbiology at the University of Gothenburg-Sahlgrenska University Hospital (Di 26/10) writes: “Before we get into on the essentials, I would like to clarify that I didn’t find any evidence quoted where it states that cash is unhygienic. Money is not dirty at all.”

But she does not share the view with Ian Thompson, Professor at the University of Oxford (Svenska Dagbladet, 26/3). It was him I referred to in my article. During an investigation, he came to the conclusion that each Krona contained an average of 39,600 bacterium. I have of course no way of knowing who is right, but it is irrelevant, I mentioned it mostly as a curiosity. It has very little relevance in the debate about whether cash should continue or not.

Is the card the rich’s friend and the poor man’s enemy? Is this is a class issue? Many seem to consider it so, and in that case I would like to refer to a meeting of the UN General Assembly in New York on 25 September this year where world leaders from the United States, Europe, Africa and Asia participated. Their conclusion was that greater attention would be placed on utilising digital technology to increase access to financial services as a means of alleviating poverty.

“An innovation, which I believe has the potential to change the lives of the poor as a new vaccine or a new crop, are digital payments,” said Bill Gates, co-founder of the Bill and Melinda Gates Foundation, before a crowded auditorium.

“Digital payments give the poor a foothold (to escape poverty) by freeing them from one of the biggest obstacles to economic security: cash.”

I know it is not directly pertinent in Sweden, but I still think it is relevant to mention that for the individual citizen, it may seem cheaper to use cash because you pay a small fee when you pay with cards. On average, the fee for a debit card is 250 SEK per year, so it is a negligible amount per transaction. But we must not forget the national perspective.

A study by the Swedish payment system implemented in 2010-2011, on behalf of the Riksbank, concluded that the socio-economic costs in 2009 for cash, bank and credit cards was 0.54 per cent of GDP. This was cash for 0.26 percent of costs, credit cards and debit cards for 0.19% 0.09% (Segendorf & J, The cost of consumer payments in Sweden, 2012).

The report shows that cash payments are economically priced and that card payments with debit cards are much cheaper. According to the Swedish Tax Agency, the black market in goods and services costs Swedish society 65 billion a year in reduced tax revenues. Recovering at least some of this money if cash disappeared could be used to legalise activities currently being carried out to the detriment of the tax payer and society. (Niklas Arvidsson, Associate Professor and lecturer in industrial dynamics at KTH, the cashless society – report of a research project, 2013)

If banks want to help ensure that we get a cashless society, they must be much more transparent than today and be seen to provide both large and small commercial entities with the benefits from the savings in the form of lower fees. Trust among the public can never be built unless it ensures that customers receive part of the profits, for example, in the form of higher deposit rates and lower lending rates. One of the strongest arguments against the cashless society is precisely that banks would have too much power. All the power over the money, according to some; the project stands or falls with whether the citizens can be convinced that it is not so.

So, we have arguments about freedom and integrity. Many people have a notion that cash is a final confidential haven. But is it really so? Is it really the small everyday purchases that you did not want to be tracked? They are the only ones that can be considered, as more traders refuse to take cash, and have the right to refuse to accept larger amounts. On Swedish Commercial website you can read that a trader can currently decide a) to not accept cash. b) to reject 1,000 kronor notes and c) can themselves set a maximum amount for cash purchases i.e. 15 000

I have thought long and hard about this and can not come up with anything other than the feeling of freedom, that cash could possibly give, is an illusion, at least for me.

Costs are as we have seen fairly well documented, but it is not the potentially enormous savings in both money and human suffering that can occur regarding the crime. This is more important than anything else, I think, because it affects terribly many people every day. I really do not know what kontantlöshet may have the impact in this area , but it is certainly worth a proper investigation .

I have to ask the question again because I have not got a good answer: What does a thief do with his stolen goods in a cashless society? How would the drug trade on the streets continue? I do not accept the sloppy response of “oh it will do, they will find a way”. We must think it through properly and thoroughly and put ourselves in the thief or drug dealer’s shoes. What do the police say about all this? How do lawyers feel about the debate?

An interesting and stimulating mind game, which readers can engage in at the dinner table is: You are the thief, what do you do with the TV you have just stolen if you can’t get cash for it? Your network of accomplices do not want it and the supermarket refuses to accept it in payment for the milk which you have run out of at home.

It’s nothing new really in Sweden – cashless stores.

For example Telia…

http://www.telia.se/privat/kontakt/butikerochaterforsaljare/sthlm_sergelstorg/

None of their stores have accepted cash, for several years now!

Bjorn is completely wrong about this, and dangerously so when all the consequences of what he suggests are worked out. He says “I challenge anyone to come up with reasons….” etc, and yet when I’ve emailed the Abba Museum and Universal with reasons, I’ve been ignored. I believe Bjorn is decent but misguided.

Is Bjorn becoming a bit of a Howard Hughes? All that talk about cash being dirty is mindboggling– is he getting OCD about germs?

The story is that he became concerned – understandably – when his son was robbed. What he doesn’t seem to realise is that if a credit card is taken instead of cash, what happens can be far, far worse. A thief who takes cash gets as far away from you as possible, and quickly as possible. A thief who takes a credit card has to get your pin number and also make you unable to raise the alarm while he has time to use the card. Imprisonment and torture are frequently involved. thankfully nothing of the sort happened to Bjorn’s son, but if Bjorn had his way with a cashless society, that’s what would follow.

It’s a big scheme- good luck to Bjorn. He seems to have a lot of views to send out to the world these days. It’s all rather leaning on technology, and I am not certain if a cashless society is a fool-proof system. It simply implies that as a person you need to be registered in the ‘grid’, otherwise you are literally worthless. I am not sure if this is a solution to a better world myself when things should be simplified down. Nothing wrong with real cash; germs and all. And I have to say the rhetoric is mildly ‘comical’. Still a huge fan of ABBA, but only when Bjorn doesn’t sing lead.

What makes me astonished about Swedish society is the fact that they refuse to see the power of the financial banks. The fact that they do know anything about you. Swedish society don’t care about data privacy or protection.

From the buying behavior of the clients in “good and bad” till the power to suspend your account – without prior warning so that people can put their money into a secure place.

Swedish society don’t see tha fact, that virtual money only belongs to the bank – not their bank clients. Cash money belongs to me. I can even put it into my pillow without the bank having any knowledge of it.

I cannot understand after all economic crises the world has been going through how people can be in such good faith towards thrid parties.

Perhaps if the historic trail of transactions were as transparent as Bjorn believes they should be now, people would never have problems with the tax authorities!

I work for a charity advising people in financial difficulties. The poorest get no help from the banks and finance companies who control the cards, which are just a form of currency controlled by the private sector..

Trying to put the subject in perspective, “money” is a symbolic media that is agreed upon and that constitues a numeric, accumulable, divisible and transfereable and somehow stable system at which all the economy’s goods may then be given a corresponding money value by its users in the markets.

Therefore this symbolic medium serves as exchange mechanism for those that wish to sell and buy goods.

This system requires certain level of trust in the institutions that support it and in the actual chosen media. In relatively recent times, the monetary system and particularly the chosen media (coins and notes) needed to have a value in itself or backing it, hence the coins were either made of stable priced metals (gold, silver).

Later on, those valuable metals could be hold at secure storage places and a certified note issued, thus its value could be easily transported in order to complete goods/properties’ transferences. Nevertheless, at anytime the note holder could go to the institution storing the metal and actually retire the metal in exchange for the note.

Plastic money and virtual money were developed when the institutions and secure information transference media achieved a higher sophistication level. It continues to evolve in this ‘ease-of-use” direction.

With all this in view we can easily see that the main underlaying condition for an evolved “cashless” money system is trust and correspondingly, a complex system of assurances to the many parties involved. Technological advances do come to help in this regard, but up to the level to which those advances are distributed and have minimun levels of accesibilty by the ENTIRE society, simply because the monetary system is of first neccessity for everyone in a society.

Of course these conditions rules out most of the actual banking system as being the proveyors of such, considering how it is set up and obviously by taking in account the many important problems they recently had in USA, UK and Europe. Governmental systems could be put in place instead, which would arise a new set of situations and problems.

Furthermore such system has to provide at least the same level of flexibility than the cash does and not fall in machine-like rigis protocols in various conditions and singularity cases like remote locations, extreme weather and enviromental variations, accidental events and eccentric uses.

In my view, the evolutionay effort Bjorn strives for is already taking place incertain restricted places and broadly in several economic sectors, for instance; financial markets move billions of cashless transactions on a nonstop daily basis. However, cash does still have a place and role.

At 2013 a mixed system seems to be the best answer for economies that comprise many different sectors and users… not so obviously, several sectors and users function at the equivalent of 2000, 1990, 1980, 1960 an even earlier (as compared with evolved ones) in different places, industries. Just consider the coal diggers in certain parts of Southamerica or complete cities in non-developed countries or even in developed economies, not so afluent families dealing with a financial problem derived from uncovered medical expenses, etc. this is very real for billions of people at this time in this planet…

Dear Mr Ulvaeus

Are you aware of the fact that your current no-cash policy plays right into the hands of a small international cabal of banksters hoping to create a global dictatorship?

Cash is a human right – not something the elite of the 1% should use as an instrument to dictate the lives of others.

Are you aware of the fact that when your museum refuses to accept cash as payment, you are violating Swedish law?

Svea Hovrätt, ÖÄ 1269-11: ” Enligt 5 kap. 1 § andra stycket lagen (1988:1385) om Sveriges riksbank är sedlar och mynt som ges ut av Riksbanken lagliga betalningsmedel. I förarbetena till lagen anges att detta innebär att var och en är skyldig att ta emot sedlar och mynt som betalning (prop. 1986/87:143 s. 64).”

Give people the freedom to choose!

Start accepting cash today – it’s the human thing to do.

It is a shame that Björn Ulvaeus uses his name and ABBA:s name to run the arrends of the big banks. How about trying to see the issue from the view of the people and not from the view of the banks?

When cash is abandoned, people can no longer take out their money. Their money is trapped, and not available any longer. You have to buy something, to get to them! But if you don´t want to buy, but just save them before the bank crashes, Banks crash, as we all know, right?

How about this for a reason? The obvious systemic failure of our credit based system that has passed it´s saturation and therefore imposes a risk for bankers being held responsible för their doings?

What is the common denominator for the financial, ecological and social crisis? All these crises are now accelerating caused by a dysfunctional monetary system, or more popularly expressed, the financial system.

The basis for why it continually becomes more difficult to deal with these crises lies in the very foundation of our financial system, the way money is created and derives its value. In order to create sustainable capitalism an unconditionally sustainable monetary system is needed. This is because the intrinsic logic behind a monetary system controls all other economic decisions.

It controls if there is a short-term and unsustainable economic growth that benefit but a few individuals or a long-term sustainable economic growth that benefits the whole society.

The monetary process is difficult to understand for many, even for experts. The process of how banks create money is so irrational that it almost is repulsive for our way to reason.

Seemingly though, it appears as if we borrow something very valuable from the banks (money) and we are therefore more than willing to pledge something valuable in return, we even pledge to give a part of our future earnings and our possessions (assets) in the case of if we do not pay. But in reality, the relationship is just the opposite. We get something from the bank which is basically completely worthless (figures in an account or coloured paper) and it is we as borrowers who have to cover or fill these worthless digits with any value, namely the promise of performance. Money is thus created in a completely different way than most people think.

The bank has only received power from the state to create money through credit lending. Therefore, today’s money is called “debt money” or “Fiat money”. The Bible says that God created light out of nothing but the power of his words. He said: “Fiat lux” (Let there be light). Fiat money is also created from “nothing”, but their value is created through a social construction, where we cover up the “nothing” with a debt recognition and a performance promise.

Debt Money was out of this first called “Protestant” money, since they got their legitimacy through the formation of central banks in Protestant countries such as Sweden (1668) and England (1688). There is thus a religious background to today’s non-rational monetary system. The confession and the trade of guilt was a Catholic mission. Within Protestantism the trade of debt or guilt became an internalized settlement between the individual and God. The creation of money through debt recognition therefore appears like a “natural” psychological step for a guilty Protestant. Today’s money is basically based on a secular faith, nothing else. It only exists because we believe in an illusionistic, but internalized guilt.

The right to create money has previously always been confined to a state’s sovereignty. Today that right belongs to the private banks.

The ability to create money “out of nothing” is the modern industrialized world’s foundation. It really is an impressive illusionary masterpiece that requires some respect. Since we would not have the society of today and it would also have been impossible to understand it without recognizing the essence of this illusion.

All financial business that describes economy is thus based on paying back a debt, since all earned money is initially borrowed money that must be paid back. But as everyone knows, there is also an interest on debt. And since money is created through credit, this means that the compounding debt of society must continually grow as we must borrow more money to repay our debts plus interest. This means that we have indebted ourselves even more, with even more interest requirements and so on.

This is a classic vicious circle. Those who have read a bit about systems theory knows that any system that has a positive feedback is doomed to collapse. Therefore, it is a mathematical inevitability that our monetary system must sooner or later break down. The existing monetary system allows that debt grows exponentially over the years, so that is doubling at an even pace, i.e.: 2, 4, 8, 16, 32, 64. Sooner or later the system ends up in a debt crisis where states, organizations and individuals no longer have the power or will to borrow more to make more money. Money needed to create even more growth in order to pay the interest of our exponentially growing debt.

The dysfunctional monetary system of today has a wide range of adverse side effects during its final stage (before the collapse) that get more apparent and emerge as we all now are becoming aware of. The interest makes a few accumulate more bills of debt (money) while the rest are becoming increasingly indebted. Some have to go bankrupt so that others can pay their interest.

Excessive growth of debt must be met with an equally excessive economic growth, when the liabilities are covered by a performance requirement. We must therefore work more and consume more – at any given price.

Growth is hence all of the economists and politicians’ stubborn mantra. Only through growth can we even try to catch up with the exponential growth in the interest expense of our debt.

Logically our debt grows even more when we try to meet its interest requirements. So we struggle in vain no matter what we are doing. The system must, mathematically, end in a collapse as our burden of debt grows to infinity. Meanwhile, the pressure to perform increases on people, nature and our social systems. Nature’s resources will, like people, get more out of balance. The exponential need for growth do not respect the natural need for recovery.

Societies are forced to save on the lookout for opportunities to cope with the increasing burden of debt. That is what we are seeing in many countries now where states are forced to save. While at the same time citizens are expected to consume so to increase growth so that an impossible debt can be paid back. This is an equation that does not add up.

In other words, there is a self-destructive mechanism built into our monetary exchange system. A society without a functioning exchange system is a society without a functioning division of labour and is in an acute existential crisis. Our current monetary system imposes therefore a serious threat to our nations. We must realize that the monetary system now must be changed. Just a sustainable monetary ground in financial system for the exchange of values, gives us the opportunity to build a sustainable economy and therefore a sustainable and just society in the future.

I hope to Björn Ulvaeus will soon engage in a new political party

Interesting reminder of the time that Stig A used ABBA’s name on some kind of political event or cause (sorry can’t remember the details off hand but I think it was detailed in Bright Lights Dark Shadows) but was yanked by the ABBA members. Maybe the other ABBA members wouldn’t agree so much with this no-cash policy… There are still people in this world without a bank account and I think this scenario raises more questions than providing an answer!

Yeah, sure. Change the monetary system, but DO IT WHEN IT FITS THE MAJORITY OF CITIZENS. As it is now, too many people in our society would end up getting various problems.

Here is a very common ‘little’ problem:

You need cash for some reason. You go to a machine in a wall to make a withdrawal, but the machine is out of order, or empty. What options do you have? Run around and look for another machine, somewhere. If you are visiting another town, you don’t know where there are machines. So, you waste YOUR time. And your bank won’t even say ‘Sorry’ for not offering a better service.

Björn and Benny, and the rest of you who is pro-changing the system: either you have not been well informed, or you don’t care.

I certainly hope it is the former alternative, since it is very easy to remedy. I would hate seeing the image of ABBA that I have, change so drastically.

It is a shame that Björn Ulvaeus uses his name and ABBA’s name to run a crusade against something he doesn’t have the right arguments for.

I lose my respect for a person I have admired for my whole life.

It is a shame indeed – Sorry to say, indeed a shame!

Björn should be glad that the thieves, that his son had the misfortune to be harassed by, didn’t harm or torture him trying to get access to his account in a cashless society, which by the way WILL HAPPEN IN BJÖRNS WORLD without cash.

Thank you to everyone who has commented on this article.

It is obviously an emotive subject but please be reminded that personal attacks will not be tolerated, which is why some comments were not published, similarly comments not made in English.

Both viewpoints on this argument have been represented now and so, commenting on this thread is now closed.

Dear Mr. Ulvaeus, Dear Björn,

Your initiative to strive for a cashless community has been supported by us for many years. We are convinced that this initiative will be the only solution for killing the crisis and building a better world . We would like to refer to our website on this subject which is stil under construction. Up to now it is presented in several languages and will be expanded soon. Can You please take a look at it? You would be the perfect committee member for our commission, in order to get this initiative approved by the European Commission. To get important people like You in the related commission will be the very key of any possible success on this initiative. Can You please get in touch with us?

Kind regards,

Much as I respect Bjorn, I believe he is completely wrong about the supposed benefits of a cashless society, and I view his ideas and the support they sometimes receive with a great deal of concern.

There are many reasons for this, too many to list here, but to take just one: Bjorn’s initial impetus for this idea was the occasion when his son was robbed of cash. Bjorn has argued this wouldn’t happen in a cashless society, but he’s overlooked the fact that the alternative is far worse, as has been proved on a number of horrific occasions. People have been robbed of credit cards, and whereas a cash theft would have meant the thief getting away and leaving the victim quickly, the credit card thefts have entailed horrific torture to make the victim divulge pin numbers, followed by imprisonment to stop them reporting the theft until the cards could be used. In one case a victim died after being beaten and left imprisoned in his flat for two weeks.

There are other reasons why I’m against this, but the one I’ve just mentioned should be enough.

Hmmm… – Karel Claes – I believe much more on reforming the current monetary system. If what I mean by it on my blog here http://josefboberg.wordpress.com/2014/01/02/god-och-intressant-fortsattning-av-2014/#comment-11170

The average use of digital money in Europe is covered by more than 90 percent of the official spendings. This means that robbing creditcards is not a new topic and could have been an issue for many years already. May I refer to our website where it is stated that a safeguarded application and an absolute prevention of internet- and bank money fraud needs to be guaranteed. Excusive job-specialisation is required in this area. Let’s focus on the non-official money transactions, which probably are very hugh. Making this share official, automaticcally will have a fair and positive impact on everything.

Kind regards,

Yes, of course theft using credit cards has already been an issue. That’s how we already know, from crimes that have been committed, how absolutely horrific credit card theft can be. Have you actually read what I posted about people being imprisoned and tortured for credit card information and to prevent them raising the alarm for long enough for stolen credit cards to be used? In view of these points, everything you’ve posted is irrelevant. Or do you simply not care about people being imprisoned and tortured?

The wellfare of people and crimeprevention can only be improved in a world with a fair financial management. A fair financial management can only be realised through a waterproof methodology which systematicaly will guarantee an integral suppression of every financial, fiscal and social fraud. This can only be realised through a controlled and unconditiona application of digital money.

Good reasons to be cash that are rational and not emotional.

– Having life’s savings trapped in a banking system that has known systemic risk as was seen in 2008.

– Negative interest rates.

– The EU hastily forcing bail-in directive last summer.

– Propaganda in one UK newspaper about it being responsible for boom and bust when it is only a small percentage of money flowing around.

Please Björn Ulvaeus avoid this debate. You do not deserve any backlash if something goes wrong. What point is there in preventing theft on one side only to have money stolen on the other?

Here is the first victim of bail-in 🙁 :

http://www.thelocal.it/20151211/italy-moves-to-bail-out-savers-hit-by-bank-plan

Also, for people in Sweden this is a site to understand what money really is.

http://positivapengar.weebly.com/

”LUFT ATT ANDAS OCH SUVERÄNA PENGAR ATT BRUKA FINNS DET I ÖVERFLÖD AV !”

James Poulson said: A cashless society is a massive mistake Björn!

Getting rid of cash is handing over the money system to banks since they already create 97% of currency.

Not only that but all savings of people will be trapped in the banking system which, as you’ve seen, can be reckless to the point of costing billions to ordinary people and posing a threat to the entire world economy.

You are perhaps comfortable thanks to your personal fortune but this will not do any good to the middle class which has been hurting for decades now.